The Consumer Credit Crunch

As we saw in the total U.S. household debt for 2021, Americans have clearly been quite cavalier (to put it nicely) in their spending. Just in the 4th quarter of 2021, total household debt increased $333 Billion, contributing to the overall 2021 increase of $1 Trillion. Total U.S. household debt stood at $15.58 Trillion at the end of 2021.

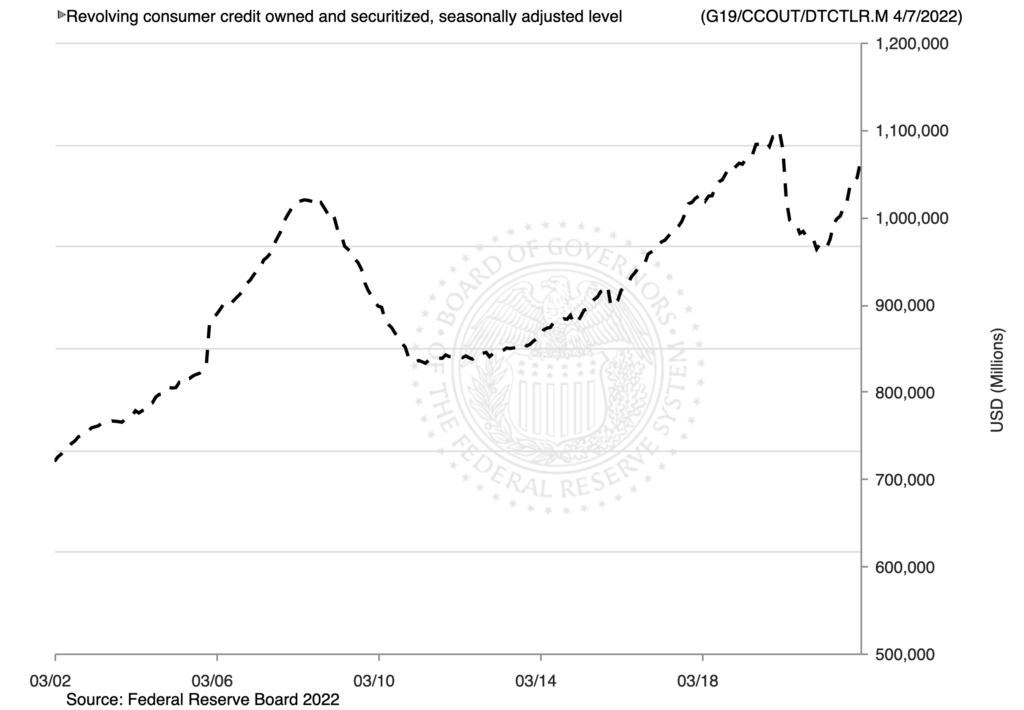

The consumer credit numbers reported by the Fed this past Thursday were exorbitant, to say the least. In February, consumer credit grew at a seasonally adjusted rate of 11.3%. Revolving credit (credit cards) increased 20.7%, while non-revolving credit (mortgages, student and car loans) increased 8.4%. Revolving credit jumped 5 FOLD from January 2022 to February 2022, just in time for all of the non-existent hallmark holiday shopping, I suppose. Not to mention the looming APR increases that we’re about to see in lieu of Fed benchmark rate hikes.

Aside from the egregious consumer credit numbers that we’ve seen thus far this year, every claim of of “continued economic recovery” through 2022 was based on the assumption that the consumer would remain strong and liquid throughout. Both things I think we can agree are objectively NOT true. Goldman Sachs recently revised their GDP forecast for 2022 to 1.75%, as their originally claim was so astronomically outlandish it was actually kind of embarrassing. You don’t even need a college degree to see that the American consumer is just beaten down and exhasuted at this point.

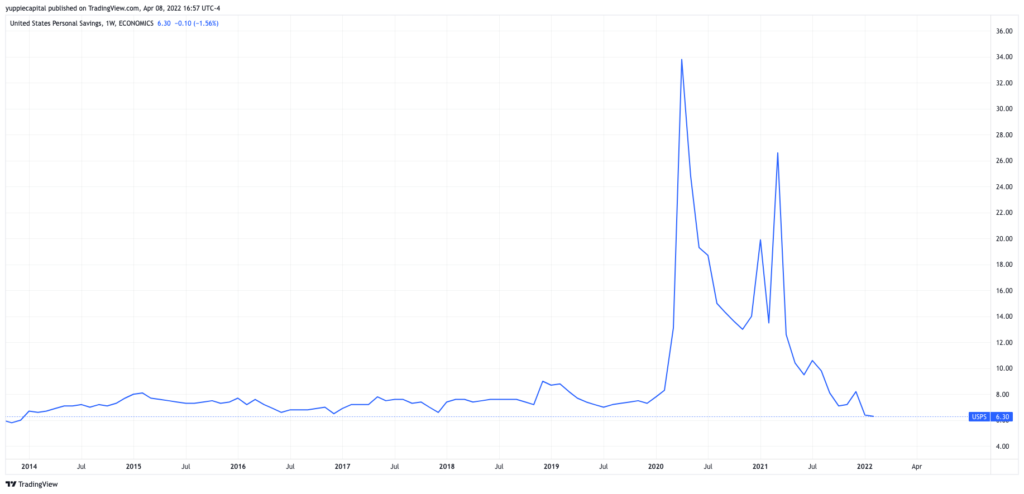

Any instance of a strong economic continuity can pretty much be squashed now, as American consumers have emptied their personal savings accumulated during the onset of the COVID-19 pandemic. Aside from the lack of government stimulus, outrageous CPI prints will continue to drain Americans of their incomes.

While inflation is just one of the economic headwinds the country is facing, the Fed is also simultaneously raising benchmark rates (although 25 bps hikes are about as useful as a poopy flavored lollipop), and shrinking their swollen balance sheet within the coming months.

With the yield curve just added to the “FLASHING RECESSIONARY INDICATORS”, it’s very clear that 2022 will be an uphill battle for the U.S. economy. Who knows where the equities and bond markets will go? I don’t know if it’s appropriate to say we’re on the total brink of collapse, but it’s ostensibly going to get quite ugly. And just to say again that any economist (most of them, honestly) who predicted a robust economy throughout 2022 is just a big, dumb, idiot.

Enjoy the ride, people.