The Housing Top Is In

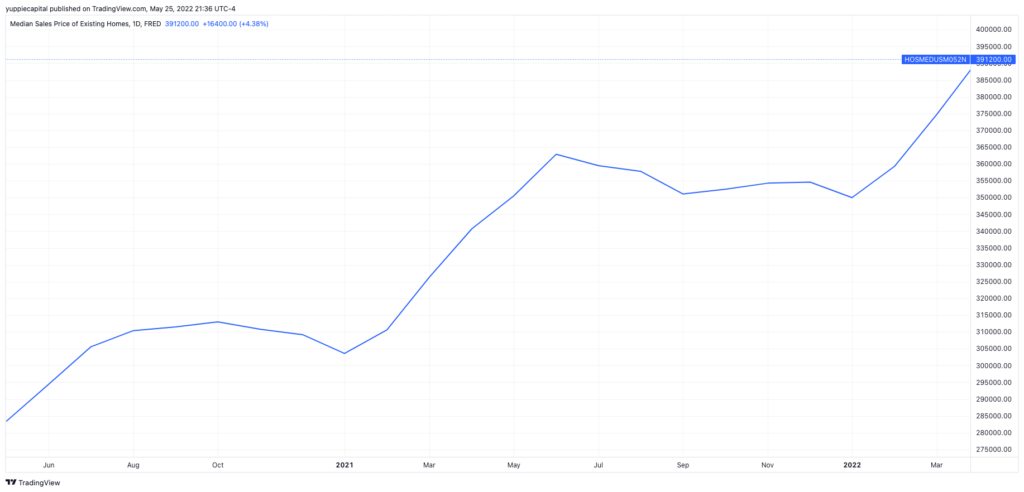

With mortgage rates going absolutely nuclear in an absolute cry for help, that hasn’t stopped home prices from reaching astronomical highs. The median sale price for existing homes reached $391,200 in April 2022, up nearly 15% from a year prior, and almost 40% from two years prior.

Obviously this was before the Federal Reserve embarked on the mission of a lifetime, single-handedly backstopping the corporate bond market while injecting trillions of dollars into the financial system via quantitative easing (both in the form of U.S. Treasury Debt and Mortgage Backed Securities).

At this point, it’s quite clear that buyers are quite literally exhausted, and many have just exited the market completely as a result of astronomical premiums coupled with relatively higher rates (although rates are still quite low from historical standards). Although demand is drying up incredibly quickly and it seems as though the music has finally stopped.

This isn’t to say that there will be an outright crash in home prices (it’s highly unlikely that that’s the case). U.S. mortgage originations are down to just $424.5 Billion in Q1 2022, as compared to $524.9 Billion in Q4 2021. By some back of the napkin math, there was ~$1 Billion decline in loan originations based on a 1% increase in the 30Y fixed rate mortgage. The demand simply isn’t there anymore. Although it’s not entirely out of the realm of possibilities that we’ll see the May median home sale price top last month’s, I think it’s highly unlikely.

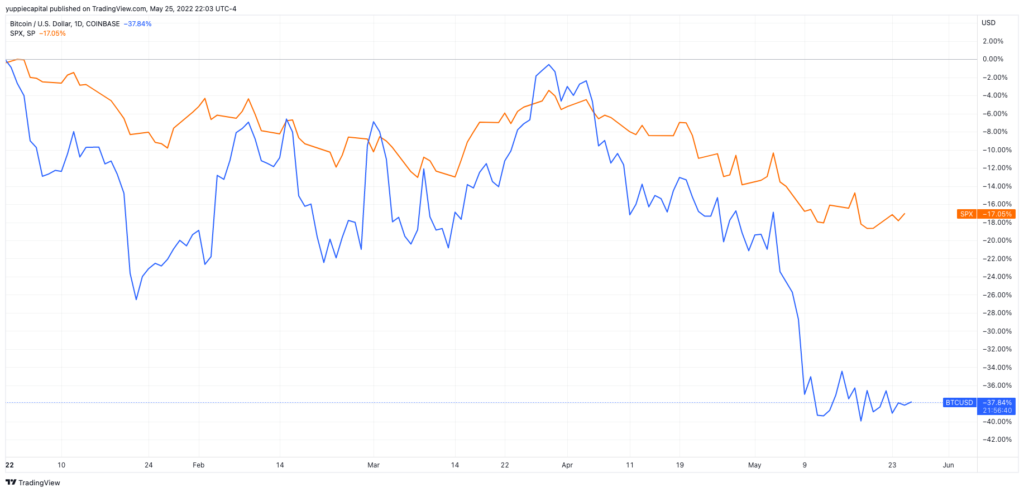

We are seeing an overall tightening (no pun intended) of macro conditions across the board. Virtually every asset class that has benefited greatly from the most epic and euphoric bull run in the history of the universe is now seeing some type of price correction.

I hate to even include Bitcoin in the same topic of conversation as the broad equities market, but it emphasizes the risk-off trade that we are currently watching unfold before us, and housing is no exception. The housing market typically lags the broader equities market, and the huge drawdown across stocks so far this year will lend some insight as to what direction the housing market is going. And this drawdown in equities comes under minute rate hikes by the Federal Reserve, and no QT!

While I do think that equities markets have faced a decent amount of selling pressure, and are due to return back up to outer space, I don’t necessarily think the same goes for the housing market. April 2022 will market the largest median home price sale of this decade. Book it.