The Yen Is Trash…For Now?

We are pretty much watching history unfold in the foreign exchange market, as virtually every currency against the dollar is getting absolutely upended. Who would’ve thought?! Most notably, though, the Japanese Yen is having a particularly tough go at it, with their currency reaching lows vs. the U.S. Dollar not seen in over 20 years. You hate to see it.

The U.S. Dollar has gained noticeable strength against virtually every other currency (not just the Yen) in the advent of aggressive Federal Reserve intervention in an economic scene where inflation is out here taking literally zero prisoners. At a very very high level, one can presume that the U.S. Dollar has had such an overwhelming resurgence for two main reasons: a rising rate environment spurred by the Fed (higher real rates attract foreign investments in the currency), and better economic outlook compared to others (many of which reside within the Eurozone). These two factors come at a stark contrast to the Japanese fiscal and macro status-quo.

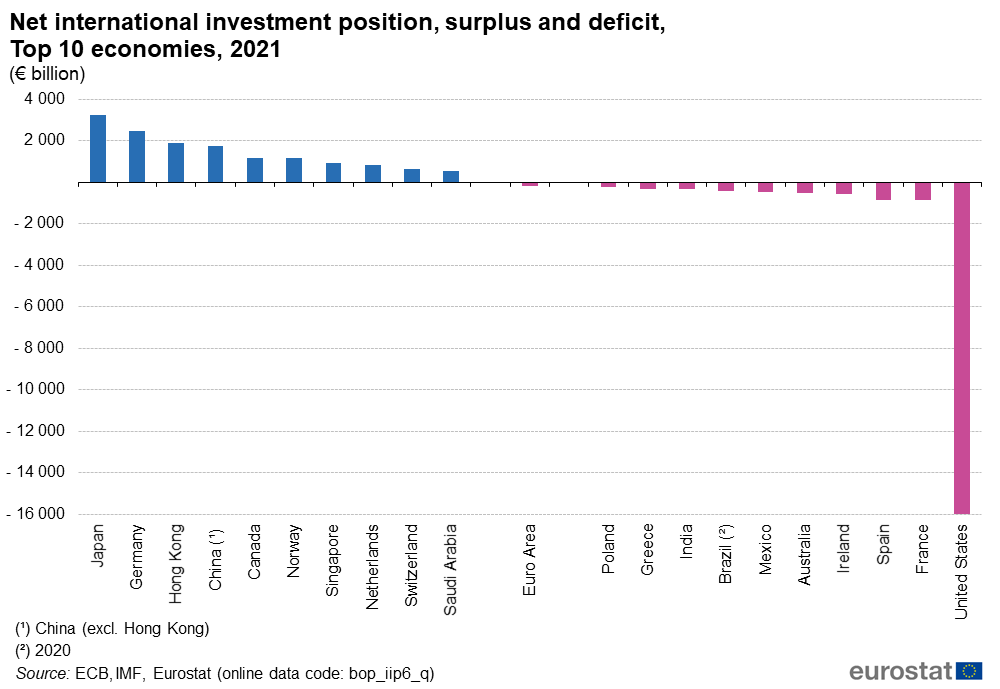

Japan is in a unique position. Japan is the largest net creditor in the world by a fairly decent margin. Currently, Japan’s net international investment position (NIIP) is a whopping $3.5 Trillion. HOW YOU GON’ GO BIG ON BIG?! Any triggering event of capital inflows into Japan will prove to be a cascading effect which will ultimately strengthen the Yen. With most of their currency overseas, an aforementioned event would send the Yen absolutely nuclear (no offense).

Japan has also been absent of tourism (which it so desperately relies on) in the advent of the COVID-19 pandemic. With a travel surplus of ~$50 Billion back in 2019, that figure now is…basically zero. SOMEBODY DO SOMETHING.

Although, there is talk that the BoJ governors will go full Krugmanomics and Greenspan era MMT and institute yield curve control to artificially maintain real rates negative, which would basically crater the value of the Yen. The BoJ is no stranger to Dracnonian measures when it comes to Monetary policy, so there is a chance where the parabolic Yen trade doesn’t come to fruition. Although that may very well be the case, Wall Skreet analysts will be watching the currency closely in hopes of hitting an absolutely devious lick.