U.S. Economic Shrinkage (1.4% To Be Exact)

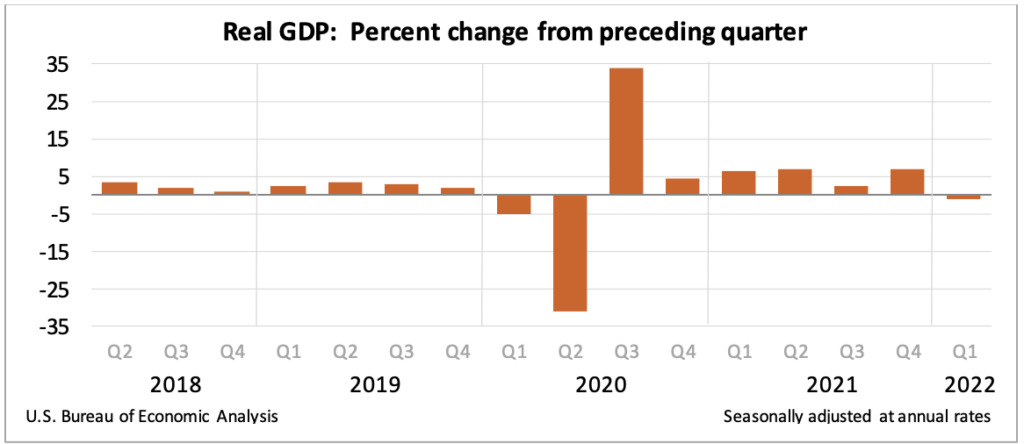

“I WAS IN THE POOOOOOL!” Real GDP shrank 1.4% in the first quarter of 2022, according to the advance estimate from the Bureau of Economic Analysis. This shows a stark contrast to the 6.9% annual “growth” rate seen in the fourth quarter of last year. This is the weakest GDP number since the Spring of 2020, when the world literally shut down in the onset of the COVID-19 pandemic. Suffice to say that recession lasted literally only one month (thanks to our friends over at the Federal Reserve).

I’d also like to point out that virtually every Wall Street Analyst was expecting a positive GDP print this quarter, and virtually all of them were…

The widening trade deficit is seen through inventories which slowed this quarter, compared to the large stockpiles amassed throughout the entire year of 2021. Lower government spending was also down. A huge swing in net exports was also the largest contributor to this abysmal GDP report. Consumers are also showing their weakness (although PCE did show an increase) here with price gains across the board discouraging many, and also driving consumer sentiment to near-record lows. The consumer is king, right? At least in this economy they are. And by the transitive property (shoutout all my mathematicians), plummeting consumer confidence doesn’t exactly bode well for the future macro outlook. This Q1 GDP number is exactly a reflection of that.

All of this with just the beginning of new supply chain constraints present a portentous tone for the U.S. GDP forecast for the remainder of the year. Some will say that the fundamentals are still strong within the U.S. economy, citing resilient consumers (at least for the time being), low unemployment, and only meager 50bps rate hikes forthcoming from the Fed.

Services spending appears to be up as of recent. STR, a hospitality data and analytics company, reported that hotel occupancy was 65.8% in the week ending April 23rd, compared to 49.6% at the end of January. Services spending was a large contributor to the GDP, essentially keeping it from falling even lower than the 1.4% number we saw today. Good thing Goldman revised their GDP outlook for 2022 earlier this year. By virtue of their revised number, they’re likely right on track. And unfortunately we won’t have the Fed here to save us this time around.