Wal(Mart) of Worry

As if the dim lights, questionable individuals, and poor customer service wasn’t enough, Walmart announced today that it was cutting its profit outlook for the second quarter and fiscal year 2023. The company turned to high food and fuel prices were the main driver of a decrease in consumers’ ability to buy general merchandise (lol). “.. Food inflation is double digits and higher than at the end of Q1. This is affecting customers’ ability to spend on general merchandise categories and requiring more markdowns to move through the inventory, particularly apparel,” said Walmart. The stock fell 9% in after-hours trading, bringing TGT, DLTR, BBY, and AMZN down with it.

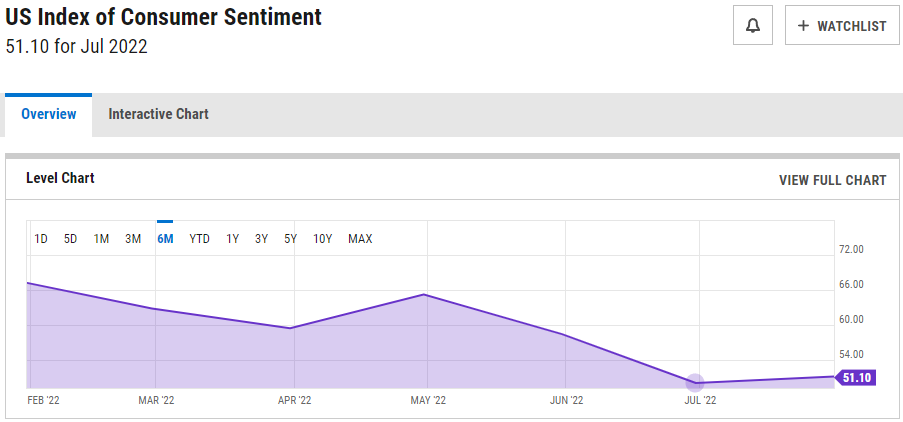

The company expects an adjusted EPS decline to around 8-9%, an operating income decline of 13-14%, and net sales growth to be around 7.5%. The adjustments shouldn’t come as a shock to investors after TGT announced a poor outlook on earnings earlier in June. The company cut its profit outlook twice in three weeks, stating that it was trying to properly manage inventory until the end of 2022 after an overflow of items hit its warehouses. At the end of April, Target’s inventory was 43% higher compared to last year according to Barron’s. Walmart and the company are likely anticipating a continued decline in consumer sentiment heading into the remainder of the year as inflation continues to heat up and layoffs continue to rise. In addition to this, the market and its participants are anticipating a GDP report on Thursday that could signal a recession but according to President Biden, “God willing,” the United States is “not coming into a recession”.

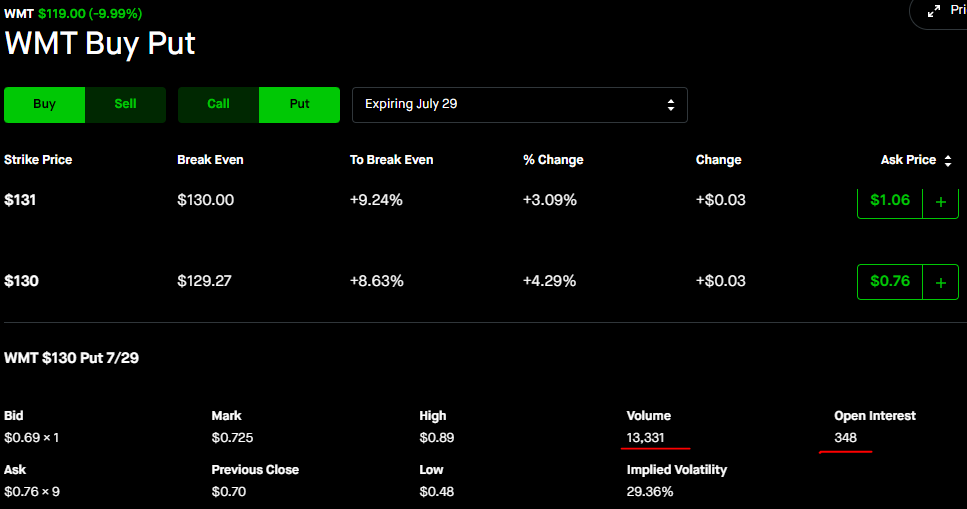

As usual, any option-related activity will be mentioned in one of my articles when I can. Earlier today there was a spike in options activity in the Walmart options chain. The July 29th 130 put options traded 13,331 contracts against the 348 open interest. It comes as a shock to some since WMT doesn’t move too much during trading sessions. The company’s implied move for the week was about +/-3 dollars but this uptick in volume which is more than 10x the open interest was a key giveaway. According to @optionshawk, the buyer purchased 12,000 contracts at once so someone had the information beforehand. The options traded around 0.71 cents ($71) a contract and will likely open up at about $9.00 ($900) a contract. When in doubt, follow the options.

Thanks for reading and make sure to follow @wallskreet, @glizzyoptions, & @yuppiecapital for more.