What Is Happening With Chinese Stocks?

In an absolutely nuclear squeeze, Chinese stocks jumped across the board during this past week of trading. The NASDAQ Golden Dragon China Index gained over 30% on the week ending March 18th.

During the later half of 2021, as a part of a slew of regulatory changes from the CCP, Chinese tech stocks, along with virtually ever other China-based U.S. listed stock, were sent into a downward spiral with presumably no way out. The CCP enacted the Personal Information Protection Law (PIPL) essentially made it more difficult for companies and or app makers to collect users’ data.

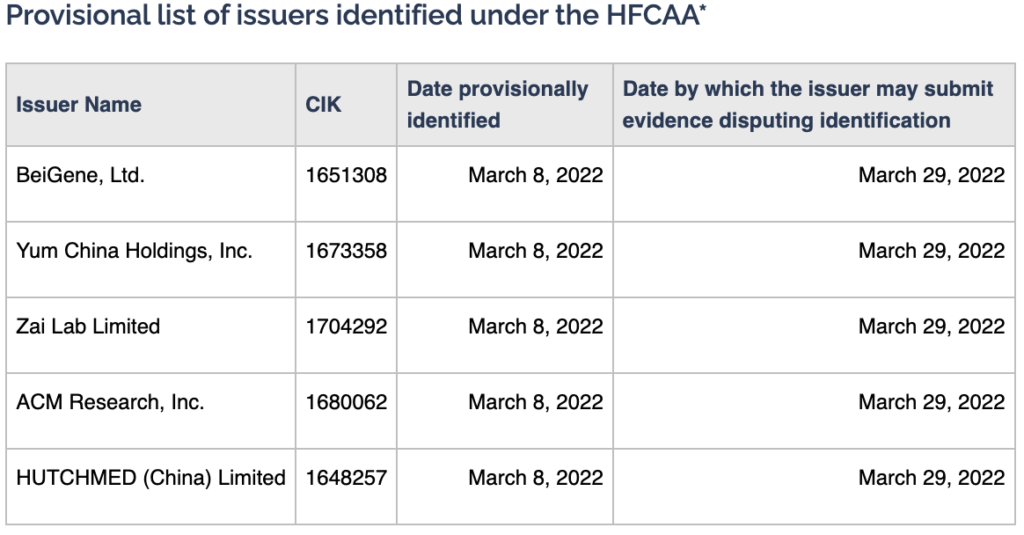

Prior to regulatory changes made by the CCP, the U.S. had passed a law (Holding Foreign Companies Accountable Act) which required more oversight into Chinese companies’ financial statements, to which Xi Jin Ping replied, “nah, fam.” Chinese securities regulators stated it “opposes the politicisation of securities regulation by some forces.” Now I’m not quite sure how a more stringent auditing process would be categorized as “political”, but plead your case, I suppose.

The clock is now ticking for companies to either comply, or face de-listing. The SEC named five China-based U.S. listed companies (Yum China Holdings, BeiGene Ltd, Zai Lab Limited, ACM Research, & HUTCHMED Limited). Yum also did mention in a previous regulatory filing that they were in jeopardy of de-listing in early 2024 barring any compliance from the CCP and their syndicates.

And now to go back on a very strong week for Chinese stocks, it’s ostensibly so that the sellers were just exhausted, the recipe for a fresh short squeeze was in working order. Either that, or the Algos got fresh intel off of the presumed success of further talks between the U.S. and China regarding agreement to the terms within the HFCAA, or some variation. If that’s the case, the companies remained listed, and liquid (let’s hope so).